For the purpose of investing consider different options: purchase physical precious metal, shares, stock exchange trading, etc. One of the popular tools that allow to attach means, is unallocated bullion account в Sberbank. This method has significant advantages, which allows us to consider it among the first. But most often the profit at the initial stage of owning an MLA account is small, you need to know how to increase it with minimal risks.

What is a metal account in Sberbank and how it works: term, current

An MLA or depersonalized metal account is the right to own a valuable metal. It holds not gold or means of payment, and grams are displayed. Opening an MLA is a type of transaction where the client gets the ownership of yellow or other expensive material. It can be sold. When the account closes, the client receives the proceeds of the transaction. In this case, an MLA is also an auxiliary tool that displays information about the metal purchased.

An impersonal account is called an impersonal account because valuable materials are displayed without identifying features (there is no hallmark, other types of branding, or other parameters). You can only see the quantity, which means there is no reference to the physical precious metal.

The functions performed by impersonal metal accounts at Sberbank:

- Investment: gold (and other metals) is a means of investment, after a while you can get a profit, its value depends on various factors (the main one is the difference in price);

- keeping precious metal for a long time gives the opportunity to provide stability to their own funds, they are stored in the OMC, but in the form of valuable material, you can not change it (the standard format for displaying information on precious metals).

There are two varieties of MLA. To understand which one is better, you need to know how each is supposed to work:

- urgent: it is limited by a time limit, it is not possible to receive funds before the end of the specified period, the client is warned about it to avoid misunderstandings, the advantage of the option is the possibility of earning quickly - interest is accrued on the current impersonal metal account (they are presented as grams);

- current or on demand: OMS is more favorable when considering the option of investing or holding funds for the future, because no interest is accrued, the amount of profit is determined by the difference in exchange rates.

Metals for placement on the MLA

The MLA deposit in Sberbank in different means of payment is executed. Options:

- Platinum (Pt): it is recommended to buy at least 0.1 grams of the metal, it has a white noble color, luster, looks attractive, it is more popular due to the properties of the precious metal (hard, but refractory, high density), platinum is often used to improve the properties of gold, but the combined material is used to produce fakes, so it is better to contact Sberbank to invest in such material where quality is guaranteed precious metal when opening/closing an account, no additional expertise is required;

- silver (Ag): costs less than other precious metals, but is still popular due to the large volumes of mining, availability, it is a soft gray material (in its pure form) with a muted luster, Sberbank opens metal accounts of this type, provided that the volume of white material is not less than 1 g;

- Gold: the permissible minimum when opening an MLA in Sberbank - 0.1 grams, the metal is soft, yellow, when checking the quality, it emits a sound that remotely resembles crystal, Au is used more often than others - this is a historical fact, so the price of the precious metal often determines the global market trends, among Sberbank customers Au also became the most in demand;

- Palladium (Pd), a platinum group metal, is also valuable, although not as high as Pt; the recommended amount for a metal deposit in Sberbank is 0.1 grams.

Metal yield calculator

There is a tool on Sberbank's website that allows you to determine the approximate benefit of opening an impersonal account. It is necessary to determine:

- type of metals (1 or more);

- the duration of the deposit: for 1 month, six months and more, it is possible to choose an arbitrary number of days;

- account opening dates: the time frame can affect the price, because analysts usually make predictions about the price of precious metals over a long period;

- the estimated amount of the deposit.

Sberbank often indicates which metals are available at the moment, when those that are currently unavailable will become available. This allows the client to plan their spending, actions when trying to open an MLA.

The calculator allows you to calculate the yield of the instrument of investment in precious metals of certain types.

Who can open a gold account with Sberbank

The longer precious metals are in an OMC account, the higher the probability of changes in the exchange rate, the higher the profit when you sell them. But when opening it, a number of rules must be observed. First of all, it should be taken into account that an MLA is not for individuals. Registration of the business form is required. Only legal entities, individual entrepreneurs can open an account of this type.

Where you can open an account

To perform any operation, you should refer to the functionality of Sberbank's website. Here you can clarify how to open an account, where it can be done, as well as find out the addresses of branches (which of them work with MLA).

Office

If until recently there was no possibility or need to open an impersonal metal account at Sberbank, it is better to go straight to the office (any nearby one, if there is a service for working with such instruments). Here is a clear demonstration of what you should do (what operations to perform) to open an OMS (if you have to repeat them without an employee of the bank).

Sberbank Online

It is necessary to log in. Go to the "Sberbank Online" tab. Here will appear fields for entering personal data. When the authorization/registration is successfully completed, you can select the appropriate tab, where the information of interest will be located. The client leaves an application or immediately opens a metal account with Sberbank.

Mobile application

To manage an account opened with Sberbank, a mobile application has been developed. It provides access to your Sberbank Online profile. The functionality is simpler than on the website, but the main functions are available. A gold deposit in Sberbank, made through the website or mobile app, allows you to perform the same tasks.

The procedure for opening, the necessary data. Step by step instructions

When registering on the Sberbank website, the basic data is provided. The auxiliary information is pulled up along with them. This means that it is not necessary to enter personal data every time. Registration of a gold deposit with Sberbank is not available for individuals. If the potential client is a sole proprietorship or individual entrepreneur, he can use the instructions for opening an MLA:

- You need to go to Sberbank's website or use the mobile app.

- It is necessary to pass authorization, go to the pre-created personal account.

- Select the "Metal accounts" section.

- The type of metal, other parameters of the deposit (period, amount, etc.) are determined.

- Having studied the terms of the contract, the amount corresponding to costs a certain amount of precious metal, which will later be displayed on the account.

Opening an MLA is a free procedure. Funds that are paid at the stage of account opening are fully converted into a precious metal account. Its amount will be displayed here as well.

Transactions on the MHI account

Today a Sberbank customer is offered to perform various actions:

- allowed to accept physical gold for the purpose of transferring to OMC, it allows to increase the total amount of gramsThe Bank set fixed rates for gold of a certain quality, the type of precious metal;

- you can get an account statement;

- storage valuable metal (bars), for which Sberbank charges a small fee;

- issuance of physical precious metal (gold only) on customer request.

Scheme of earnings on metals: metal quotes, spread

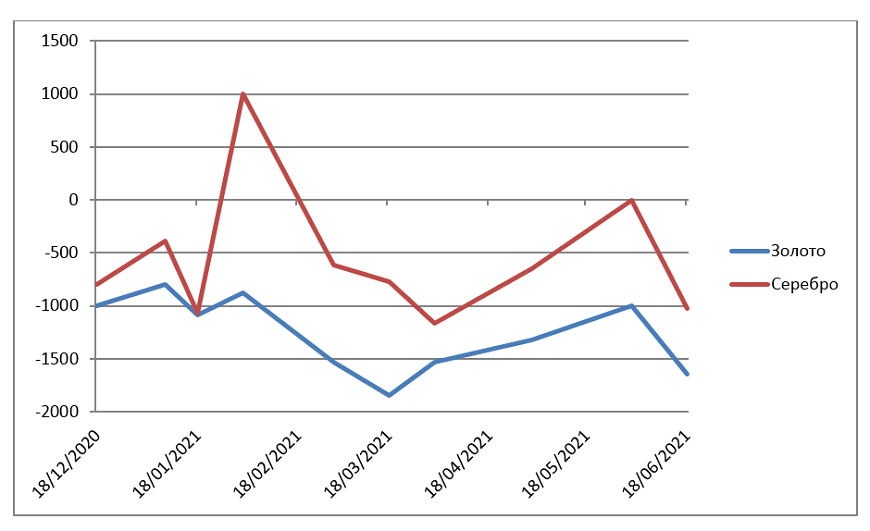

The spread is the difference between the buy and sell price. This concept is the basis of impersonal metal accounts. Thanks to it, a financial institution makes a profit. For Sberbank's clients, an IRA is a profitable investment. The chart of the yield of different types of precious metals (monthly changes):

As you can see from the chart, the return on gold over a short period of time is zero or goes into minus. This means that it makes no sense to invest in Au for six months to a year. The situation with silver is better, but also not ideal. Earnings on this metal are small because of the low price, even if the yield exceeds the zero threshold.

The bank's benefit

Sberbank in determining the rate of precious metal is guided by the Central Bank. It offers its clients gold by valuewhich is slightly lower than the rate. Then the sale determines a different price - an overpriced one. For Sberbank it is like this more profitable - he profits on the spread. The financial institution attracts additional funds through the MLA, gets the opportunity to dispose of them.

Customer Revenue

If a term deposit is considered, profits are earned when interest is accrued. Payments are made when the account is closed. They are not too high, because such MIIs are opened for a short period. The standard version of an impersonal metal account does not provide the client with dividends. You can keep precious metal in Sberbank or resell it, tracking the exchange rate of the currency (dollar), gold - they are interrelated.

So, the client's earnings are formed by "playing" on the quotes.

Whether to pay tax on profits

There is still no taxation scheme for MLA. This attracts investors. Financiers also have no idea who should pay taxes: Sberbank or the client, which is due to the intertwining of actions. Thus, the client pays for the precious metal when opening an account. However, the bank uses these funds. At the closing of the MLA there is a sale and purchase transaction. All these features make it impossible to oblige one of the parties to pay tax. The legislation is still "silent" on this matter.

Is the deposit insured

Gold, like most other precious metals, is a stable means of investment. This means that even when the exchange rate falls, bullion is worth a lot. And there is always the risk of bank liquidation. Sberbank, from this point of view, is one of the reliable financial institutions. But if you look at the situation theoretically, it may turn out that clients will lose their deposits and their profits. This is due to the fact that the MLA provision does not belong to the deposit insurance system.

How to cash the profits

There is a rule - profit is paid when the account is closed. This is due to the fact that the client does not earn as long as the precious metal is in the account. It is necessary to sell the gold that has been accumulated. Only in this case one can make a profit - it corresponds to the difference between the purchase and sale of the precious metal. Otherwise, when closing the account, the client will receive only the funds which correspond to the amount of proceeds from the sale of the precious metal from the MMA by the bank.

Gold account in Sberbank: pros and cons

Competitors' offers

Considering that when making a deposit on the MLA account most often there is no interest rate, the offers of different financial institutions are almost the same. There are some features to consider when choosing a bank to open an MLA account.

To be able to work comfortably, one should pay attention to the functionality of the financial institution's website and mobile application. It is specified which metals are offered for purchase, as well as their necessary amount for the transaction. To open a term deposit one should also find out the interest rate (if it is provided).

Video: depersonalized metal account in Sberbank, terms and conditions of opening

Is a metal account in the sberbank beneficial: reviews

I came to Sberbank based on the reviews. Several acquaintances made a profit thanks to MLA. So far I am just figuring it out: I opened an account and made a small investment. Now I am waiting for something to change, but I do not see any growth in the price of gold (only 1 month has passed). They say that this is normal, it needs more time.

I had a deposit in the MLA almost from the moment such a feature appeared. Recently I checked the rate, and it increased several times. I sold gold, it came out a decent amount, and in fact I did not have to do anything to get it.

I opened an MLA before the crisis, and when the exchange rate of the precious metal started going up, I sold it. I gained an amount which was twice as much as the initial amount. I got a thrill, now I want to repeat the success, but I understand that such cases will not be given often. On the other hand, if I did not have a metal account, the money would not appear. Most likely, I will recommend it to my friends.

Lawyer's Commentary