Gold - one of the oldest ways of making a purchase/sale. Metal has a high value and unusual properties (rarity, aesthetics, malleability, durability, etc.). Alloy of the highest grade is used for the production of investment coins and ingots. The price of 1 gram of gold changes all the time. It rises predominantly, but it can also fall. To invest in gold Forecast must show a certain dynamic.

Gold in the financial system

Different means and methods are used in the formation of market institutions and their development. One option is the capital market, investments. This also includes the market for precious metals. Its formation and formation is connected with the gold and foreign exchange reserve, where Au is one of the main valuable resources. In particular, thanks to this metal it is possible to stabilize the economy in case of unforeseen situations. The precious metal performs several functions at once:

- means of economic regulation;

- resource support;

- building a reputation as a solvent state;

- confirmation of the ability to fulfill monetary obligations.

The scarcity of gold in earlier times led to the metal being replaced by other means of payment. Today coins made of this material are highly valued, which is partly due to their rarity. But the value formed over hundreds of years also plays a role - the precious metal is one of the most expensive.

Characteristics and analysis of a financial asset

There are a large number of investment objects, and among them is gold. Many buyers perceive investment bars and coins as such. But they are not the only ones who use the precious metal, for many corporations and states Au is a financial instrument of the capital market.

And that's exactly companies and banking institutions view gold as an asset. In this case, the metal is not perceived as a physical body, but exists in documentary and non-documentary (electronic) form. This variant of handling the precious metal requires special treatment, because Au can go up in price, sometimes its price falls.

And the changes are not always gradual (for example, as in the case of appreciation of precious metal due to the obvious causes affecting this market), it happens and the sharp fall / rise in price. This requires the analysis of gold: not only external factors (economy, politics), but also internal ones (characteristics of financial assets) are taken into consideration.

The industry uses only a small portion of the mined gold (no more than 10%), the rest is distributed among the spheres: savings, jewelry production, and investment.

Zero yield

When making a forecast for gold, all factors are taken into account. One of the characteristics of Au as an asset is zero yield. It means that the deposit does not bring much profit today, now, i.e. "in the moment". It takes time to wait for the price of gold to change essentially (the metal goes up in price), and then there will be an opportunity to gain profit. However, in the near future, after investing in bullion or coins, you just have to wait.

On the one hand, the zero yield is a disadvantage, because the precious metal is a self-preserving asset, which does not require costs, but also does not need cash injections. On the other hand, this state of affairs allows you to invest in gold because this method of investing wins against the background of currency deposits and alternative instruments. By comparison, the yield on securities is negative.

The trend of exchange rate growth

The exchange rate of the precious metal is largely determined by its "relationship" to the state currency. gold reserve of the country provides "support" for the ruble: the amount of aurum corresponds to the amount of money reserves. As soon as there is a more significant difference between these values, the exchange rate immediately changes and precious metal value. If the rate of issuance of the state currency exceeds the rate of gold miningThe forecast will have only one option - the Au exchange rate will start to rise, and the ruble - to fall.

Cannot be a geopolitical tool

Most countries have their own sources yellow metal. It is lifted from the bowels of the earth, and this is done with the participation of state and private companies, as well as foreign organizations. This means that no one has a monopoly on this market, which prevents the use of valuable material as a lever of pressure on other states in case of unforeseen circumstances.

5 Macroeconomic Factors Affecting the Position and Rate of Gold

Gold analytics can be performed as long as all or the vast majority of the factors are covered. Among them:

- disproportionate growth in consumer prices relative to the low intensity of consumption;

- manipulation on exchanges;

- depreciation of money;

- conflicts at the international level;

- currency quotes.

Inflation rate

It must be remembered that it is gold that provides support for the state currency, not the other way around. For this reason, paper money does not have a significant impact on the precious metal. But this factor is still taken into account, as an indirect one. There must be a correlation: as soon as the intensity of inflation increases, the yellow metal goes up in price. In practice this rule does not work very well. Yes, there is some correlation between the currency and gold, but it is rather ephemeral and not always obvious. The reasons for this:

- Au is not a raw material, and therefore behaves differently compared to raw materials (oil, ferrous metal);

- In periods of economic development, interest in the precious metal decreases somewhat; gold has to compete with other assets and currencies for the attention of investors.

Change in exchange rates

Considering that the state as well as foreign currencies have no significant influence on gold, the slightest exchange rate changes most often lead to the strengthening of the precious metal on the market. And there is one condition for such correlation to remain: the purchasing power must be high. This allows you to invest in gold bars and coins.

Threat of war

When stability is disturbed, there is always a return to precious metals because it is the most predictable asset. It holds its ground better than other economic instruments in difficult times when unforeseen events occur, such as military conflict, death of a ruler, etc.

Interest rates of stock markets

There is an inverse dependence between movements at stock exchanges (including Forex, Roboforex - trading online) and precious metal prices. At the moments of rise securities (bonds, shares) are more attractive, which bring dividends in a short period of time. When they cost falls, gold, on the contrary, begins to rise in price.

Supply and demand ratio

To avoid a sharp drop in the value of the precious metal, it is necessary to ensure its even distribution among the main industries: industrial, jewelry, investment. The demand, as well as the supply of gold, is determined by many organizations (state, private, foreign, international). Among them:

- Central banks of different countries;

- IMF and similar organizations;

- leading investment companies.

The concept of the level of investor confidence, the impact on the gold forecast

When there is an upward trend in the price of a precious metal, the human factor can hinder investment. It's about investors' attitudes to the environment: political stability, economic growth, monetary policy failures, and the government's ability to pay its bills. Many are wary of conducting transactions when they do not trust these changes. Such behavior is assessed in a certain way - the concept of "investor confidence index" is introduced. This is a measure of investors' willingness to take a likely risk.

Mistrust grows against the background of various factors. Among them are changes in the initial conditions for the application of certain economic instruments. Investor distrust may also be caused by the prospect of attracting foreign capital. However, resistance on their part weakens as soon as obvious improvements in the state of the country's economy become evident.

And just as important is the trust that national investors can give to innovations in the country when they attract foreign capital. Similarly, the authorities seek to maintain the confidence of foreign investors, for which purpose they preserve and maintain the reputation of a solvent state, capable of meeting its obligations, including those that imply the need to repay a loan or other loan.

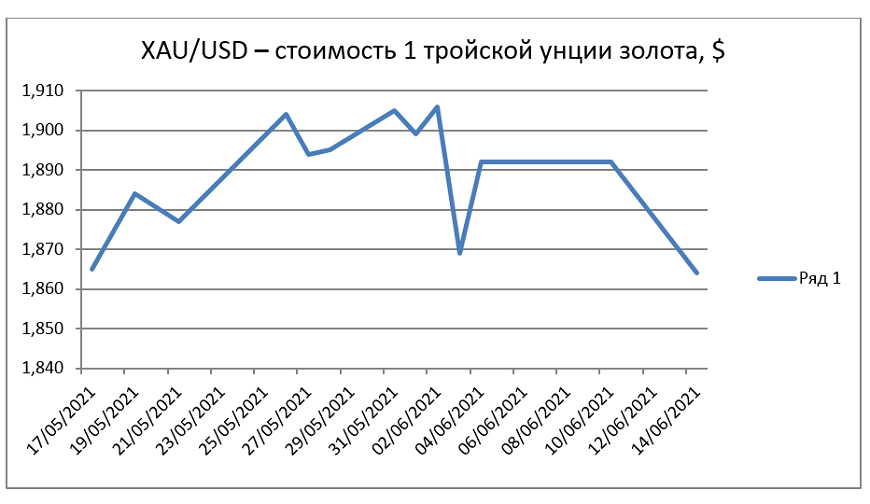

Gold rate analytics by chart

Gold rate forecast is supported by a variety of data, including an analysis of the value of the precious metal. The most convenient format for this is a chart:

A year ago, the real Au yield fell. The value of 1 troy ounce of gold changed to a limit value, was more than $2,000. For some time before that, few could think that such a sharp jump was possible, they were cautiously predicting further change. But the exchange rate of gold soon changed slightly again. In 2021, as can be seen in the chart, the value of the precious metal is fluctuating in a fairly wide range, but has never yet reached the level of the previous year. This trend is expected to continue in the future.

Forecast for gold demand in the coming years

A rising rate inspires optimism, whereas a falling rate inspires apathy and pessimism. To prepare for one or another result, it is suggested to study gold price forecasts. And the short-term and long-term analysis of the market is made.

In the short term

Among investors are observed decadent moods on the background of changes in the price of precious metal not for the better. In addition, recently there was the sale of significant volume of valuable material, the main reason being the news about the sharp collapse of treasury bonds.

The price of gold is projected to be $1,640 per troy ounce this year or next.

In the long run

Inflation is expected to rise to 3%+. At the same time, there could be a change in gold yields to previous levels. Many believe that a mere change in rates will be enough in the long run.

This is due to the rather strong inertia of the Federal Reserve's target amid inflationary pressures.

How to properly invest in gold

With the development of technology, it is possible to invest precious metal in different ways, and today almost any idea can be realized:

- contribution of funds in physical gold;

- share in investment companies;

- share purchase gold miners.

Buying bank bullion or coins

The most familiar method, because previously it was the only one available. You can buy bullion and investment coins. It is recommended to consider for this bank institutions, Sberbank is popular among the population. You should not try to buy precious metal on the exchange market, because it will be difficult to withdraw it.

This method has a disadvantage - it is necessary to pay VAT (20%), and also note the high associated costs, in addition, there are considerable spreads (the difference between the purchase and sale price).

Unit in an ETF fund

It is possible to buy shares of "gold" investment companies, they are presented on exchanges among other values, which are sold from trades. ETFs get their name from the type of assets - they only own gold. The advantage is the relatively low risk - shares can be sold like ordinary securities. But you should take into account the changes prices gold, because the investment companies completely repeat its movements on the market of precious metals.

VTB Gold BPIF

As with any method of investing, there will be additional costs when buying a mutual fund unit - for intermediaries, etc. You need to choose the company that will be most satisfied with the size of the interest rate for services. VTB Capital offers management with the lowest rate (0.22%).

Shares of major gold miners

There is a large number of companies, combines that mined gold. To get a stake in them, you have to consider public enterprises, such as Polymetal, Seligdar, etc. The advantage of such attachments is availability - shares can be purchased through the Moscow Stock Exchange. The securities will generate income (from dividends).

If shares of gold mining companies are overvalued (for example, because of the debt burden), even the most attractive gold price will not be able to change the situation.

Table: Gold forecast today, week, month, year

The price of gold is fixed daily (there is a concept of fixing) and is determined by the Central Bank. If today you can get the latest data on the prices of precious metals, then tomorrow, at the end of the week, month or year it is necessary to study the forecast made on the basis of many factors:

| Dates for 2021 | Day of the week | Price of gold (1 ounce), rubles. |

|---|---|---|

| 16.06 | Wed | |

| 17.06 | Thu | 1828 |

| 18.06 | Fri | 1838 |

| 21.06 | Mon | 1835 |

| 22.06 | W | 1829 |

| 23.06 | Wed | 1837 |

| 24.06 | Thu | 1857 |

| 25.06 | Fri | 1820 |

| 28.06 | Mon | 1828 |

| 29.06 | W | 1821 |

| 30.06 | Wed | 1824 |

| 01.07 | Thu | 1831 |

| 02.07 | Fri | 1831 |

| 05.07 | Mon | 1844 |

| 06.07 | W | 1844 |

| 07.07 | Wed | 1854 |

| 08.07 | Thu | 1844 |

| 09.07 | Fri | 1864 |

| 12.07 | Mon | 1860 |

| 13.07 | W | 1881 |

| 14.07 | Wed | 1885 |

| 15.07 | Thu | 1902 |

| 16.07 | Fri | 1907 |

| 19.07 | Mon | 1890 |

| 20.07 | W | 1878 |

| 21.07 | Wed | 1875 |

| 22.07 | Thu | 1865 |

| 23.07 | Fri | 1867 |

| 26.07 | Mon | 1855 |

| 27.07 | W | 1860 |

| 28.07 | Wed | 1848 |

| 29.07 | Thu | 1830 |

| 30.07 | Fri | 1832 |

| 02.08 | Mon | 1799 |

| 03.08 | W | 1801 |

| 04.08 | Wed | 1805 |

| 05.08 | Thu | 1802 |

| 06.08 | Fri | 1780 |

| 09.08 | Mon | 1784 |

| 10.08 | W | 1779 |

| 11.08 | SR | 1786 |

| 12.08 | Thu | 1798 |

| 13.08 | Fri | 1770 |

| 16.08 | Mon | 1757 |

| 17.08 | W | 1761 |

| 18.08 | Wed | 1769 |

| 19.08 | Thu | 1772 |

| 20.08 | Fri | 1775 |

| 23.08 | Mon | 1773 |

| 24.08 | W | 1790 |

| 25.08 | Wed | 1799 |

| 26.08 | Thu | 1804 |

| 27.08 | Fri | 1801 |

| 30.08 | Mon | 1807 |

| 31.08 | W | 1822 |

| 01.09 | Wed | 1839 |

| 02.09 | Thu | 1844 |

| 03.09 | Fri | 1838 |

| 06.09 | Mon | 1835 |

| 07.09 | W | 1854 |

| 08.09 | Wed | 1849 |

| 09.09 | Thu | 1850 |

| 10.09 | Fri | 1863 |

| 13.09 | Mon | 1860 |

| 14.09 | W | 1862 |

| 15.09 | Wed | 1865 |

| 16.09 | Thu | 1872 |

| 17.09 | Fri | 1877 |

| 20.09 | Mon | 1879 |

| 21.09 | W | 1890 |

| 22.09 | Cr | 1901 |

| 23.09 | Thu | 1899 |

| 24.09 | Fri | 1897 |

| 27.09 | Mon | 1879 |

| 28.09 | W | 1880 |

| 29.09 | Wed | 1882 |

| 30.09 | Thu | 1897 |

| 01.10 | Fri | 1870 |

| 04.10 | Mon | 1878 |

| 05.10 | W | 1860 |

| 06.10 | Wed | 1854 |

| 07.10 | Thu | 1849 |

| 08.10 | Fri | 1848 |

| 11.10 | Mon | 1829 |

| 12.10 | W | 1833 |

| 13.10 | Wed | 1834 |

| 14.10 | Thu | 1820 |

| 15.10 | Fri | 1810 |

| 18.10 | Mon | 1819 |

| 19.10 | W | 1800 |

| 20.10 | Wed | 1814 |

| 21.10 | Thu | 1760 |

| 22.10 | Fri | 1768 |

| 25.10 | Mon | 1780 |

| 26.10 | W | 1778 |

| 27.10 | Wed | 1778 |

| 28.10 | Thu | 1789 |

| 29.10 | Fri | 1790 |

| 01.11 | Mon | 1780 |

| 02.11 | W | 1769 |

| 03.11 | Wed | 1758 |

| 04.11 | Thu | 1761 |

| 05.11 | Fri | 1760 |

| 08.11 | Mon | 1764 |

| 09.11 | W | 1740 |

| 10.11 | Wed | 1743 |

| 11.11 | Thu | 1739 |

| 12.11 | Fri | 1754 |

| 15.11 | Mon | 1756 |

| 16.11 | W | 1748 |

| 17.11 | Wed | 1734 |

| 18.11 | Thu | 1733 |

| 19.11 | Fri | 1740 |

| 22.11 | Mon | 1742 |

| 23.11 | W | 1753 |

| 24.11 | Wed | 1756 |

| 25.11 | Thu | 1767 |

| 26.11 | Fri | 1770 |

| 29.11 | Mon | 1789 |

| 30.11 | W | 1758 |

| 01.12 | Wed | 1760 |

| 02.12 | Thu | 1764 |

| 03.12 | Fri | 1769 |

| 06.12 | Mon | 1770 |

| 07.12 | W | 1771 |

| 08.12 | Wed | 1765 |

| 09.12 | Thu | 1769 |

| 10.12 | Fri | 1785 |

| 13.12 | Mon | 1787 |

| 14.12 | W | 1790 |

| 15.12 | Wed | 1785 |

| 16.12 | Thu | 1784 |

| 17.12 | Fri | 1788 |

| 20.12 | Mon | 1794 |

| 21.12 | W | 1800 |

| 22.12 | Wed | 1803 |

| 23.12 | Thu | 1815 |

| 24.12 | Fri | 1829 |

| 27.12 | Mon | 1811 |

| 28.12 | W | 1824 |

| 29.12 | Wed | 1826 |

| 30.12 | Thu | 1823 |

| 31.12 | Fri | 1813 |

Video: gold forecast, ideas, recommendations

Question and answer section

How is the price of gold formed?

What does gold quote mean?

What is the spot price?

What platforms do you trade gold on?

Will gold rise in value this year?

Gold forecast by stock analysts

More than once I have heard from my colleagues that by the end of 2021 the price of gold will be higher than in the first half of the year. However, the price will not rise above the peak value of 2020. The average value will be at $1,965 per ounce. Reasons are different: decrease of geopolitical risk, conducting of monetary adaptive policy. Fluctuations of precious metal from 1900 to 2000 dollars per ounce are possible. But as a whole there will be a tendency of decrease in price Au.

Lawyer's Commentary

Addressing this issue, you must first remove from your smartphone/computer the program that provides access to the device, as scammers can control it, destroy all signs of a violation of the procedure of cooperation with the victim.