Precious metals once became such because of the special properties they possess. Man endowed gold with privileges and began to use it for settlements and transactions. Later coins and other means of payment appeared. From time to time they lost their value. To minimize losses in this case, you need to understand the process of loss in gold monetary functions - this is what kind of phenomenon, why it occurs. There are different factors, all of them from the field of economics.

The value of gold and silver for all time. The first payment systems in history

Precious metals (gold and silver) have long been used as means of payment. Metals have become a universal method of payment that has always suited all parties to a purchase/sale/exchange transaction. And gold gradually replaced silver in this role. The reasons are simple:

- rarity metal compared to most others;

- Divisibility: small pieces are no less valuable than a large bullion;

- stability prices: In most cases, the Au exchange rate continues to rise, and the funds invested in such metal are preserved even during the crisis;

- Resistance to external factors: gold does not rust, it rarely interacts with chemicals.

The same is true of silver. It has excellent physical and chemical properties that set it apart from other materials. In addition, Ag is an industrial metal; most of it is used in the production of radio components, in medicine, dentistry, in the manufacture of glassware with a reflective surface, etc. All of these properties have made silver a unique currency.

Gold by weight

In ancient times (the Middle Ages in Europe) payment with coins was made by weight. At first, it was a convenient form of payment, the main advantage was considered the simplicity of the transaction of purchase/sale. Gradually disadvantages of this method of payment started to appear: risk of loss, theft, considerable weight, as gold is characterized by significant density. Payment for large transactions, as well as for the purpose of solving global financial issues at the state level required the preparation of large quantities of precious metal. It was extremely difficult to transport.

Gold coins tended to fray and shrink in size because the metal without additives is very soft. This is one of the factors that contributed to the revision of the payment system.

Exchange of gold for a bill of exchange

Another variant of the ancient imperfect system of settlement was based on exchange. At the time of the Crusades, it was customary to pawn property (various goods, objects). In return, bills of exchange were offered, which could later be cashed for gold coins.

The first banking system

Bills of exchange, which were used to provide a guarantee for property received, took on a new form. During the existence of the Order of the Knights Templar, the first bank drafts appeared. They were very simple counterparts, but they contained all the essence of the modern system of payments on such papers.

The Templars devoted themselves to the protection of pilgrims on the roads, they also ensured the safety of the money of those who left home for the Holy Land. The system resembled a bank, the owner being the Pope, the participants in the settlement being the holders of the power of the time, and the managers being directly monks who had to keep a vow of poverty.

Currency exchange option

Monetization was a natural consequence of the development of a settlement system using gold. It appeared in different states. Even individual cities began to mint their own coins. The fragmentation in this sphere led to the emergence of a large number of money of different composition, denomination, size, weight, and even type. This made it difficult to trade, because the monetary coins of another state had no value in other territories.

That's how the money changers came into being. They were in all states. Their main function was to exchange coins of different kinds and denominations. Money changers sold their state's money, and in return they received payment units of other countries. And foreign currency was always in demand, because people of different nations began to buy the necessary coins from the changers.

The Paris Currency System and the Phenomenon of Monometallism

As gold money spread to different territories, the disadvantages of such money became more apparent, the main one being the scarcity of the precious metal. This prompted the emergence of a more physically and economically accessible currency. Silver began to be used.

When the era of gold monometallism began, the dominance of one instrument of settlement and type of means of payment was assumed. In different periods there was a predominance of one kind of coin over others, not necessarily gold:

- Ancient Rome - copper was used;

- The Russian Empire - silver.

Gold returned as the basic unit of account much later, after bimetallism. It happened closer to the twentieth century.

Approved the system of gold monometallism as the basic system at the Paris Conference (1867).

Gold monetization of Europe: pros and cons

The countries that began to use the monometallic principle of buying/selling transactions were Germany, England, France, Denmark, Sweden, Norway, and Holland. The other half of the world, where silver was still used, was considered literally backward because it did not accept the new trends in finance. The desire to establish a uniform system of payments over a large territory had some advantages:

- the ability to mint money freely;

- obtaining the right of payment in gold in unlimited quantities;

- fulfillment of obligations when exchanging paper money for gold;

- a high degree of confidence, but not in the type of tender (coins), but in the metal of which they are made - gold, by comparison, paper money was rapidly subjected to depreciation amid inflation;

- cost gold payment instruments is stable, fluctuations occur more often with changes in the volume of mined precious metal.

Demonetization of gold: causes and essence of the process

About 40 years after the establishment of gold as a single currency in a large territory, processes began to take place that contributed to the loss of the means of payment of their functions. Coins made of the precious metal no longer had the equivalent of money. This process has a name - demonetization of gold. The metal was not devalued. It was simply time to change the payment system.

One of the reasons for the withdrawal of gold money is stagnation, because Au has a stable price, and the lack of crises has a negative impact on the world economy - it does not develop. This means that the process of demonetization of gold was not originally caused by artificial reasons. The transition to paper money followed. And the main currency means of one country - dollars, at that time there were 44 countries tied to them.

This process is also called revaluation, when one currency rises in value relative to other currencies.

In 1976, the transition from gold to paper money was legally confirmed. This triggered the next round of economic development. Despite the fact that the demonetization of gold had already happened and the precious metal had passed into the category of goods, Au still remained a means of payment. The precious material formed the basis of the gold and foreign exchange reserves of various countries.

Rapid economic development and lack of actual money

When an economy develops, there is an increase in turnover, which requires funds. But this also requires an increase in the amount of mined gold, which is problematic for a variety of reasons. As a consequence, the use of precious metal as a means of payment becomes unprofitable - too expensive resource is spent. It was thought that discontinuation of the monometallic system of payments could stabilize the domestic economic market.

High cost of circulation of gold means of payment

Among the reasons for the demonetization of gold is the high price of the precious metal. Resources are needed to make this kind of money. In addition, not all countries can afford to replenish the volume of gold coins due to the lack of domestic sources Au, and the regular purchase of material is expensive.

Predominantly government regulation of the economy

When the state apparatus takes part in economic issues, makes adjustments or sets new directions, such a process is called predominant state regulation. The reasons for switching to this mode of influence may be different (poverty among the population, international competition, negative phenomena of the internal economic market). But in the case of the loss of monetary functions of the precious metal, the greatest influence of monetary policy (filling the economy with credit funds) is noted.

The emergence of the American dollar on the world stage

One of the factors that contributed to the beginning of the demonetization of gold was the strengthening of the dollar. In the U.S. the value of the currency was still ensured by gold, which could not be said about other countries, where the abolition of gold standard. In today's world there are still consequences of this distribution of power at the world level.

Increasing the rate of lending

The participation of the state in the development of the economy by increasing the importance of credit contributed to the possibility of printing money. But it was not secured by anything. There was a jump in economic development, and at the same time there was an increase in purchasing power. But other problems arose: the complexity of returns funds, debt pits, seizure of property, etc.

Lack of a competitive currency

The problems that arose did not contribute to the growth of the state currency. There was nothing to back it up, because without collateral, with an insufficiently large volume of mined gold against the background of the development of lending artificially created conditions for the gradual depreciation of money. There was nothing to offer to counterbalance the dollar, which strengthened its position, but that was until the euro appeared in Europe.

The step-by-step process of gold losing its functions

To remove gold coins from circulation, it was necessary to implement a multi-step process:

- Decrease in the volume of money. The gradual cessation of their use in the internal economic market. This meant the abandonment of the use of gold in cash circulation.

- Avoiding the use of Au as a means of payment.

- Depreciation of gold, but only as a measure of value.

- Coins ceased to play the role of a valuable means of accumulation.

- Gold has lost its last function - it is no longer considered world money.

Despite the refusal to use Au directly - in purchase/sale transactions, the use of the precious metal is still relevant, but only indirectly.

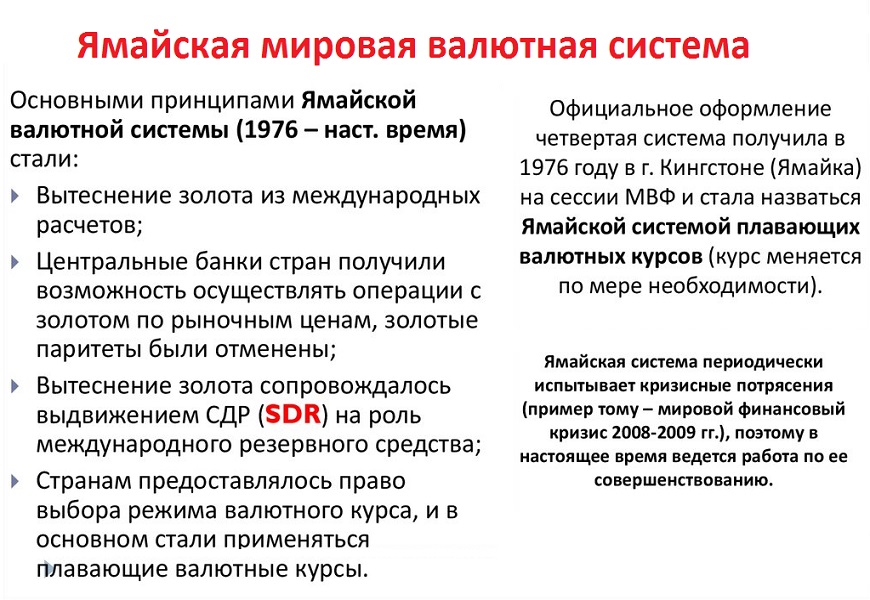

Legal confirmation of the demonetization of gold

The demonetization process was completed in 1971-1976. This happened simultaneously with the end of the Bretton Woods monetary system. It was considered a monetary system. However, it was still based on gold (the dollar was backed by the precious metal). The last stage of nullification was marked by the Jamaican Reform. It provided legal confirmation of the end of demonetization. In 1976 the Jamaican settlement system was introduced, the first of the existing ones, which was based on a new principle of forming the exchange rate (under the influence of market trends).

The value of gold today for world economies

The precious metal has lost its monetary functions, but it has not become commonplace and is still in demand on the world market. Its liquidity has not declined. The material is gold reserve of Russia, the U.S. and other countries. The emergence of paper money non-monetary system with signs obtained by demetallization, allowed the development of another direction of the economy. It is based on the principle of market determination of the exchange rate, with much attention to credit.

Due to the fact that gold is a particularly valuable metal, the denomination was notionally peaceful for the world economy. If it had been replaced by another material at that time (for example, copper), it is difficult to imagine how such a turn could have turned out. The total increase of prices, change of rates of national currencies of different countries (their total depreciation) is one of the variants. But gold, thanks to its characteristics, cushioned the fall of the world payment system.

A part of the CER.

Every year Russia increases its turnover in the gold mining industry. In addition, the state additionally purchases the precious metal. Its total share in NR is 22%, the rest being assets of other categories. Golden Reserve Today it amounts to almost 2,300 tons, which corresponds to $130 billion.

The country's creditworthiness index

The presence of a substantial amount of gold is the basis for the creation of a positive reputation (solvency in the appearance of debt obligations on loans). The assessment of creditworthiness became most active in 1970s, when the calculation system was completely changed, noted the allocation of the credit line of the economy. The methodology takes into account qualitative indicators (expert assessment) and quantitative, resulting from calculations.

Investment product: physical and virtual

A large number of investment instruments have appeared. Among them, it still has not lost its popularity precious metal. But investing in physical gold does not provide a large and quick profit, it is more often used for long-term maintenance of their capital. Large dividends can be obtained by investing in virtual gold.

Industrial Resource

A significant portion of the gold that is recovered from the earth is used in the electronics industry. It is used to create conductive coatings, make radio components, and produce microcircuits.

Jewelry raw materials

Another actively developing area of application of precious metals is the production of valuable items (jewelry). But if pure metal is used in the industry, or at least alloy with a minimum of impurities, such material cannot be used in jewelry. Jewelry is made of alloy with a lot of ligaturesThe material's strength is increased.

Chemical reagent

Gold reacts with a small number of substances. Its transformation into a liquid is facilitated by special conditions. But such a purpose is pursued much less frequently than the use of Au in electronics.

Component in the defense industry

One of the uses of the precious metal is in making targets for nuclear weapons research. Another use of gold is in rocket science.

Video: what is money, its types, functions

Expert Commentary