Profit from investments in precious metals - one of the ways to make money today. Playing on the stock exchange, gold purchase coins, stocks companies - None of these methods will most often give results if there is no experience. It is better to consider another option - to open unallocated bullion account. But it is necessary to take into account the peculiarities of such an investment tool, which will allow you to earn on investments in precious metals.

Depersonalized metal account - what is it: the concept. Metal accounts - profitable or not

The notion of a depersonalized metal account implies the display of information about the object of deposit without identifying features. A bank customer invests funds in a precious metal without any information about the hallmark, name, or stamp of the Federal Assay Office, which determines the name of the investment instrument. If you are wondering what an unmarked metal account is, you need to consider 2 definitions:

- is a contract that allows you to dispose of a certain amount of precious metal (sell, buy), when you open an account, the client pays a certain amount, which implies an investment, because the bank immediately converts the money into gold or other material at the appropriate rate;

- is an account that displays the amount of precious metal in grams, there is no more information, because at the stage of opening the physical gold is not purchased, so there is no data on the precious metal, but this does not mean that the MLA suggests the possibility of buying low quality metal, because in the bank gold has certificates, quality marks, passed the test.

When considering opening a metal account, you need to know how profitable it is - whether it will allow you to make a profit. For example, an MMA is only a tool used to make money. But it will not work on its own (except when interest is accrued).

To make a profit, it is necessary to monitor the rate of gold or other precious metal, for which an MLA account is opened. When there is an increase in the price of the precious metal, it can be sold. Then the client will receive a profit - the difference between the value of the valuable material at the time of purchase and sale.

The income will be higher if the precious metal is in the bank long enough. At the same time its price is steadily increasing. If you sell gold or silver In 6-12 months from the date of purchase, there may be no profit, and sometimes the client goes into deficit. For this reason, one should open a metal account only for a long term. In some cases, the bank client receives a profit, even if the deposit is made relatively recently. This happens during the crisis, when the price of precious metal changes sharply, can quickly rise or fall. The rate gradually recovers, if you sell the gold in time, the income will amount to 20-30% (the precedent of 2009).

Statistically profitable are considered MLAs that are opened for 3-5 years or more.

Types of depersonalized metal accounts

When a client applies to a bank, it assumes the possibility of opening an MLA without any variations. But the conditions for investing funds are different. Different types of impersonal metal accounts are considered: deposit and demand accounts. There is a significant difference between them, but more often the latter option is formalized.

Deposit MLA

Another name - fixed-term. It is so called because of the peculiarities of registration/closing: when concluding an agreement with the bank, the term for which the OMS account is opened is stipulated. It is short, and at the end of it, the client sells the precious metal and receives profit from the interest accrued over time (displayed in grams).

On-demand MHI

Current MLA ("on demand") can be opened for any term, interest is not accrued, and the client receives profit due to the dynamics of prices for precious metals. Only it will be necessary to independently track information about rates of valuable materials on specialized aggregators of rates, such as porssikurssit.fiAfter the opening of the current account of OMC, the further fate of the deposit is solely in the hands of its owner. When quotations reach the required level, the values are sold.

The first type of depersonalized metal account (deposit account) has the advantage - the bank customer is guaranteed to receive income, even if it is small, because with a short investment period of another type would not be able to make a profit at all.

Second option (current impersonal account) has a disadvantage compared to the first: it is impossible to predict whether it will be possible to earn income from the precious metal. But even if the rate of precious metal does not change over several years, such an investment method You can also find positive qualities - it is the stability of funds. If you keep money in the bank in a special account, investing in precious metals, you can be sure of their safety. Such funds are not subject to inflation.

Metals for impersonal accounts

It is assumed that a metal account can only be opened to transfer the equivalent of a valuable metal to it. The Bank offers several options for materials:

The low cost of Ag is noted, which is partly why the metal is popular. Widespread distribution, as well as a frequent choice for investment, is also due to the large volume of production. The rate of silver changes more quickly, which allows you to make a profit. Gold account is opened quite often, because historically, this material is the most trusted. The metals of the platinum group receive less attention from depositors, which is undeserved, given their high cost.

Palladium has the highest yield, which allows for more profits. It is followed by silver and gold. In last place is palladium. Despite this positioning of precious metals in the ranking of the most profitable investments, funds are most often invested in Au.

Palladium - 31 %

The metal is used in industry, not just in jewelry. This ensures a stable demand for it, which increases the reliability of investments. A disadvantage is the complicated mining procedure. This explains why palladium is produced in relatively small amounts. This peculiarity additionally contributes to the appreciation of the material. But its reserves in nature are much larger than those of gold.

Silver - 26%

The yield is higher than Au, but this metal is chosen much less often than Au. Analysts believe that the properties of silver are undervalued, and therefore such material is quite cheap. Frequent fluctuations in the exchange rate make it possible to buy and sell the precious metal on a regular basis, which gives some income. But its level is still low. Experts believe that one day the price of silver will rise. But it is not known when it will happen.

Gold - 25%

The Au rate is relatively stable. It means that its yield remains low, but until the crisis occurs. So, one should choose such metal for investments when it is not planned to "play" on quotations, to earn on OMS, and the purpose is only safety of funds. Many people believe by default that gold today is the most valuable metal, and that is why they do not consider other variants, even if platinum group materials beat Au in quotations.

Platinum - 6%

Opening a metal account with Pd investing allows you to profit when there is a decline in the price of gold. These metals are interrelated, which means you can use one to track the value of the other. Platinum is highly priced, noble, and hard, all of which have made it popular of late. The main supplier is South Africa, which may cause the level of production of the precious metal to decrease because of the political situation in Africa. Such changes may affect the price of platinum, which should be taken into consideration when choosing such precious metal.

How to know the profitability of metal

Yield - an indicator determined by the change (dynamics) of the value of the precious metals in which metal accounts are opened. Different options are possible:

- Demand" deposit: yield without interest, made up of the price of precious metal at the time of purchase and sale, to make a profit, you must wait until the value increases, if this does not happen, the customer will not make a profit, can incur losses;

- Term: the depositor receives a profit due to the exchange rate quotation, as well as the bank accrues interest for the period for which the MLA was opened, if the funds are withdrawn earlier, additional profit in the form of % is not taken into account.

On the London Stock Exchange, the price of the precious metal is pegged to the dollar, the unit of account - troy ounce (31,1 г). The Russian Central Bank translates currency into rubles and ounces into grams.

Yield calculator: download

There is a calculator for calculating returns on the websites of banks. It is used if you plan to make investments in various values. The calculator can be found by going to the section on deposits, precious metals. The information you need to specify:

- type of precious metal;

- period when it is planned to make a deposit, according to this information on metals will be provided, as it changes;

- amount in rubles.

How to open an MLA account

There are different possibilities:

- office visit: if there is a branch near you, where it is proposed to open a metal account, a bank employee will help you to make a deposit, the advantage of this option is the opportunity to get additional advice as the operations are performed, so the client will be able to perform similar actions independently in the future;

- online banking (the option is not available in all banks): operations are performed from home, it is sufficient to register on the website of the selected bank, for this purpose personal data are provided, but you must enter them once, later the procedure of entering through online banking is simplified;

- mobile application in your phone: you can also access the online bank from your smartphone, if the registration procedure has already been performed from a desktop computer, you can perform all operations after a simple authorization.

To open an unallocated metal account, it is necessary to follow a simple procedure:

- choose a bank, an important factor - reliability, but you should also pay attention to the exchange rate of precious metals, currencies, it will be more profitable to invest money;

- determine the amount that the client is willing to invest, the recommended minimum is 0.1 or 1 g, which depends on the type of metal, with a more favorable rate offered for a large deposit;

- assess the possibility to buy more precious metal after opening an account;

- open a current account, from which funds will be transferred to the MLA.

Analysis of the market participants by criteria

Investing money in precious metals It is advisable, provided that the information on the subject of the deposit (gold, silver, etc.) and this segment of the market has been studied. It is important to understand how the yield is determined, what it depends on, what the quotes are needed for. Forecasts of well-known analysts should be taken into account. And information from several sources is studied, because the point of view of one specialist may limit the angle of view of a potential investor.

Bank Reliability

The metal account to be opened must be secured by guarantees, at least conditionally, if not by the bank (financial institution does not insure metal deposits on MHI), then by indirect parameters - for this choose a bank by its degree of reliability. To find out which of the state or commercial financial institutions can be trusted, factors are taken into account:

- study of the indicators of individual credit ratings, they are made by the world agencies;

- collection of publicly available information about the owners, holders of major shareholdings, and reviews in the media space;

- Checking the bank's number in the ratings - compiled by private and public organizations;

- assessment of financial performance, compliance with NBU regulations.

It is not always possible to gather this information on your own, so it is advisable to ask your friends who are knowledgeable in such matters. An alternative is to consult a specialist.

Commission for opening

It is free to open an account. However, the investor faces losses when he wants to close the account, to sell the precious metal. In this case, not only the tax is paid, but also the bank's commission. And it is quite large. One should be prepared for the fact that the costs of bullion production, insurance, and transportation to the bank are also paid by the investor.

Spread size

The difference between the price of a precious metal when buying and selling is often significant. This phenomenon has a name - the spread. It can be different, which is also considered one of the parameters for selecting a bank. But low spread is not always the criterion of trust. A bank can fail to meet the requirements of an investor by other parameters.

Restrictions on transactions

The size of the deposit is different, which depends on the bank's conditions. The size of the amount is not limited, as there are no requirements for the minimum balance on the account (it is allowed to reduce it to 0). However, there are age restrictions. Transactions can be made by persons of legal age, otherwise they must have representatives.

Procedure for opening an MLA in a bank

The main points of making a metal deposit are the same for all financial institutions because the basis is a standard procedure. Each bank may have its own requirements, they perform a complementary function, but can contribute to the creation of a new algorithm that allows you to open an impersonal metal account. Today many financial institutions offer such service: VTB, Rosselkhozbank, Alfa-Bank, etc.

Sberbank

You can go to the nearest branch and ask beforehand if it is possible to open an MLA. Sberbank provides such an option even in online banking, which distinguishes it from others. The main steps of the registration online:

- Log in or register.

- Select the "Metal accounts" section.

- Determine the type of metal, the size of the deposit, and other parameters. Fill in the form.

- After studying the terms of the contract, pay for the purchase of the metal.

Promsvyazbank

You can open an MLA if you already have a current account in rubles. Promsvyazbank does not offer the opportunity to perform such an operation online. On the site you can only study information about deposits in precious metals. Here you select the nearest branch. You need to go there, taking identity documents, TIN. The consultant on the spot will help to perform all the operations: you need to transfer funds from the current account to the metal account, sign the contract.

Gazprombank

The bank does not charge interest on the OMS deposit, so you can only open an account "on demand". There are no storage costs for precious metal, the size of the deposit is unlimited. The main steps, how you can open an account at Gazprombank:

- Study the conditions on the website.

- Select a branch.

- Apply to one of the bank offices with the documents (passport, TIN).

- After the transfer of funds, execution of the contract the investor receives a copy of it, as well as a cash voucher for crediting valuable materials to the account.

Uralsib

The Bank opens and services metal accounts at 8 Efremova St., Moscow. You need to go to the office with documents. Most often a passport is enough. But if necessary a Taxpayer Identification Number may be required. The person who enters into the agreement gets a copy. In addition a document of enrollment is issued gold or silver to the account. When the owner will add metal to the MLA, the data in it will change as well.

Alfa Bank

Opening and maintaining an account is free of charge. There is no commission for transactions. There are restrictions on the minimum deposit amount in precious metals: from 1g for gold, platinum, palladium, from 100g for silver. The contract for a metal deposit is concluded in person. The client is advised to choose an Alfa-Bank branch that carries out such operations. The opening hours on Fridays are different: until 4 pm instead of 5:15 pm as on weekdays.

VTB

The MLA is issued on condition of a personal visit to the bank. It is necessary to prepare a passport. VTB's website does not provide any other information about the documents that need to be provided. This is a sufficient basis to prepare for the transaction. An employee of the bank will draw up an agreement, you also need a current account (currency - rubles), and it must be opened in the same bank. Then the funds are transferred to the MHI. The client receives documents: an agreement on the deposit and a cashier's slip confirming that he is the owner of the precious metal in the metal account.

What you need to open an MLA

When visiting a bank to perform various operations, most often a passport is required. Without it, it will be problematic to open an account, to get a loan. Similarly, there is a rule for processing a metal deposit - passport is required. Sometimes they ask for TIN (if the client is new, has not yet opened a current account with the bank). One must have a sufficient amount (in cash or electronic equivalent). It is also required to open a current account with a bank, which provides the opportunity to use a financial and instrument (MLA) for their purposes.

Unallocated metal account agreement

When a metal deposit is executed, its basis is an agreement drawn up between the parties (the bank and the client). It contains all the necessary information about the subject of the transaction: the terms of performance of obligations, the value of the precious metal on the unallocated account, etc. Appendices to the contract:

- an application to open an MLA;

- an application for the purchase of valuable metal.

Maintaining MLA: the rules of the game with quotes and spread

Quotations change 2-3 times a day, and various factors contribute to it (the market situation has the strongest impact). The Bank sets the price of precious metal above or below the National Bank price. If an investor buys gold when registering an MLA, the price is lower than the one set by the Central Bank. When the client decides to sell the precious metal, the bank sets the price higher than that set by the Central Bank. This is how the spread is formed, which allows the financial institution to earn money. The investor can monitor quotations on the bank's website if he wants to sell gold, silver, and other valuable material at a profit.

Taxation and insurance MHI

Profit tax is levied on income received from operations with precious metals (13%). It is necessary to specify the income in the next year's declaration. Often the bank itself acts as a tax agent, which gives it the right to withhold the required amount when transferring funds.

Income tax is not included in the declaration if the amount is less than 250 thousand rubles, or the precious metal was stored in an MLA account for 3 years or more.

Deposits on MHI are not covered by the insurance system. For this reason, it is important to choose the bank carefully at the initial stage, when just planning to make a metal deposit.

Advantages and disadvantages of MLA as a means of investment

Deciding to buy a virtual precious metal, study the advantages, disadvantages of this way of investing. Pros:

- There is no need to buy physical gold or silver, which speeds up the procedure of sale and conversion of valuable material into rubles;

- no risk of loss of invested funds (unless it was decided to sell the values on the wave of falling rates);

- There is no need to check the quality of metal when opening an impersonal account;

- The minimum volume of valuable material for making a deposit - from 1 g;

- No taxes are paid if the gold/silver is held in the account for more than 3 years;

- no logistics costs are assumed, since there is no physical property (precious metal);

- No fee is charged when opening an account and performing operations while maintaining it;

- The spread is high enough, but it is less than in "live" gold transactions;

- an uncomplicated operation of opening an impersonal account.

Cons:

- payment of taxes when storing the precious metal for less than 3 years and when selling it;

- The mechanism of transferring payment funds between MLA accounts is poorly developed;

- there is no insurance if the bank's license is revoked or the deposit is threatened for any other reason.

How to get funds from the MLA: money or bullion

An MLA account contains virtual precious metal, it is not usually converted to physical gold or silver. Cash is offered, which is due to the rising costs of logistics, expertise. This would fall on the shoulders of the depositor.

When the depositor decides to withdraw the physical metal, he will have to pay VAT.

Current cost of metals on the OMC

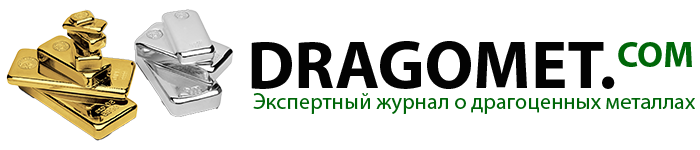

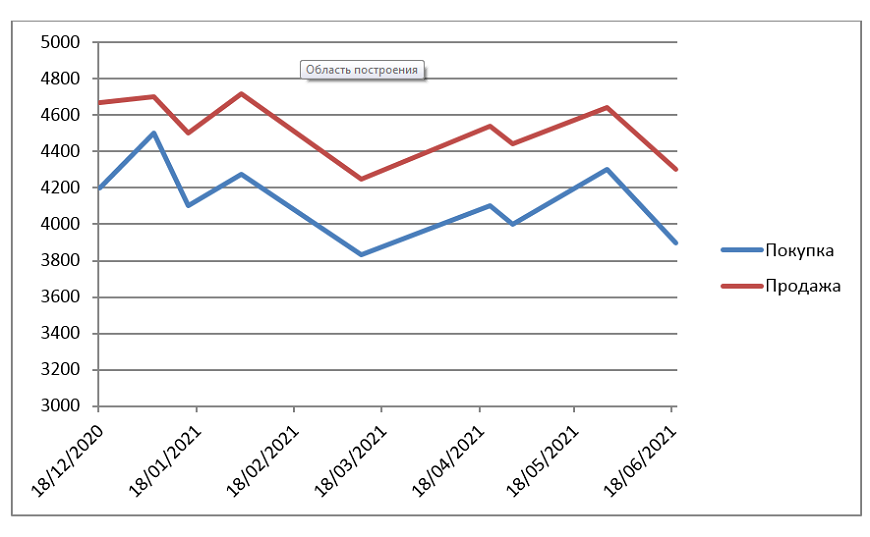

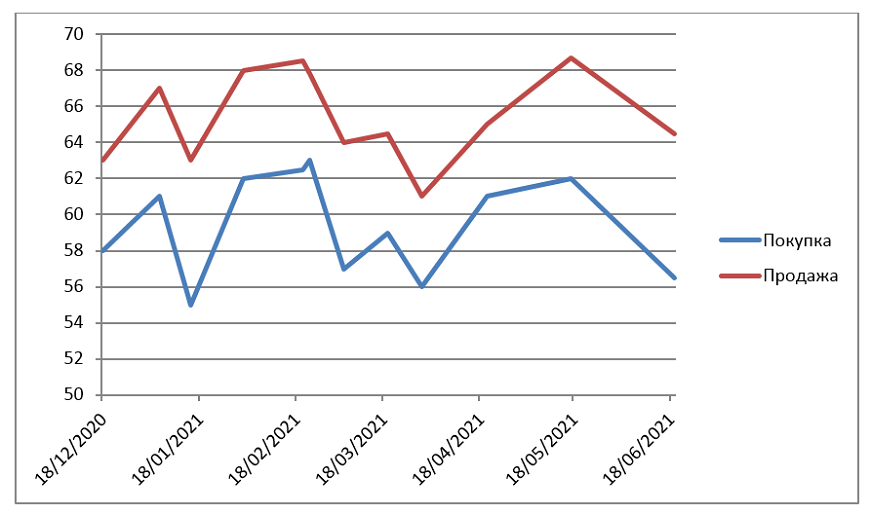

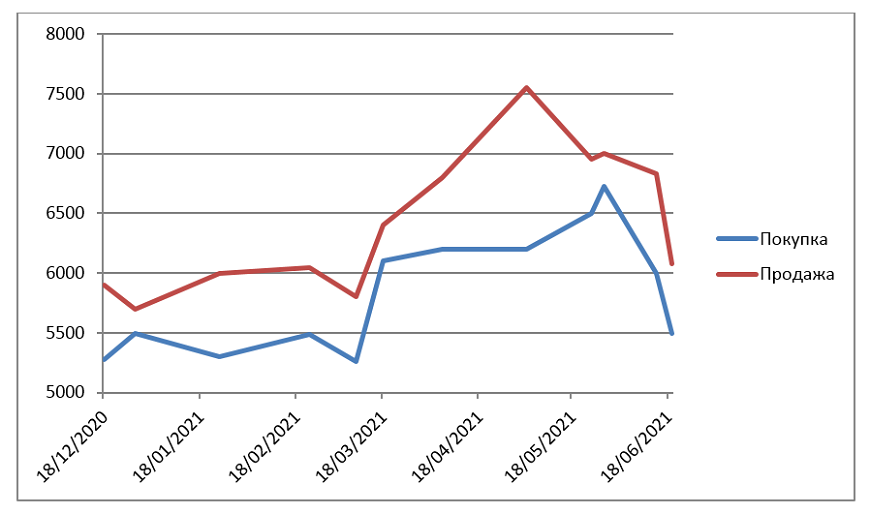

If you don't sell the metal on time (the depositor will find himself in minus), it will lead to a debt to the bank. And the debtor will be obliged to repay it. To prevent this from happening, it is recommended to follow the quotations of the valuable material. Current data as of June 2021 (Sberbank):

Gold

Silver

Palladium

Platinum

Video: impersonal metal accounts, pros and cons

Question and answer section:

Can I open more than one MLA account?

How much money do I need to open an account for the first time?

How does Tinkoff Bank open an MLA account?

An impersonal metal account: reviews

I hold gold in the IOF, have not yet withdrawn it (Sberbank). The exchange rate jumped a lot after the last crisis, but I did not have time to catch the wave, I made a deposit later. It has been almost 1 year since registration, it is too early to withdraw funds, I am waiting. The exchange rate is slowly but growing again.

I opened a metal account 3 years ago (Alfa Bank), now I can sell gold without income tax, which is nice (as a bonus). But I do not plan to withdraw funds, let them still lie there. I see that the gold so far periodically rises and falls, there is no accurate prediction. The plan is to keep this deposit for tens of years, for the sake of interest. In any case I will not lose much, as I started with 1g of gold.

I get my salary from Gazprombank, they also offered me an MLA, and I agreed. I found it attractive that I could invest a small part of my money (I took 10 g of palladium) and later make a profit.

Opinion of a financial broker

Legal Opinion